Michelle (Director)

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

Canceled Westbrook Book Group

Conference Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesThis program has been cancelled. We are sorry for the inconvenience.

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

Library Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

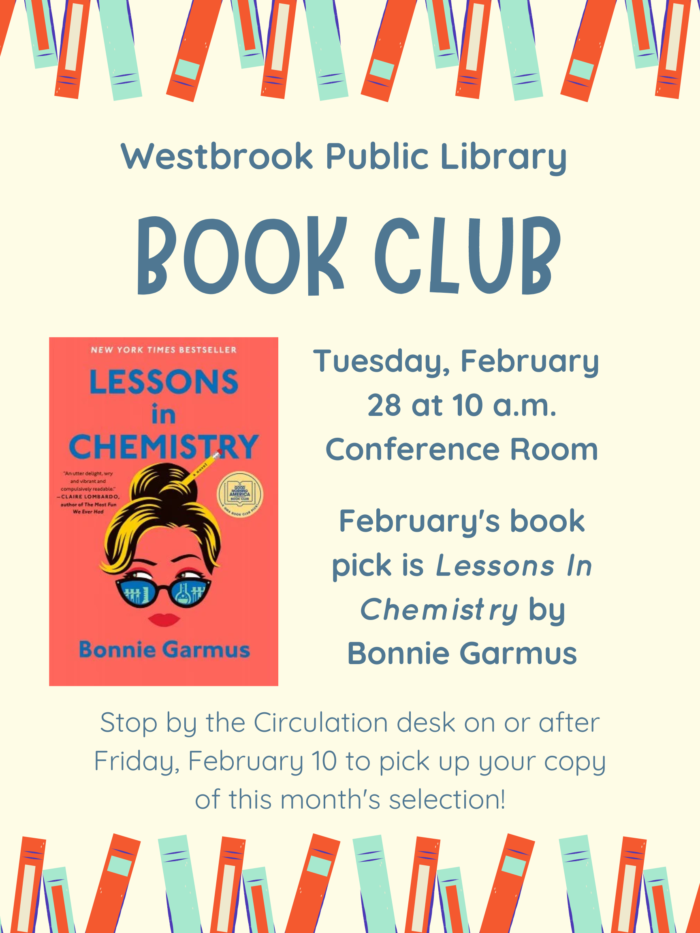

Westbrook Book Group

Conference Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesMore information will be coming shortly!

AARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

Library Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP Tax Aide

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesAARP trained volunteers will be back again to provide patrons with free and confidential tax preparation. Note that Tax-Aide volunteers cannot prepare returns for taxpayers who changed their state of primary residence during 2022 or for taxpayers who run a business with inventory, depreciation, or a loss. Four sites to obtain assistance: 1.Westbrook Public Library,...

Westbrook Book Group

Conference Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesMore information will be coming shortly!

Library Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesWestbrook Book Group

Conference Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesRegistration is not required.

Library Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesWestbrook Book Group

Conference Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesMore information will be coming shortly!

Canceled Library Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesLibrary Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesCanceled Library Board of Trustees

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesLibrary Board of Trustees

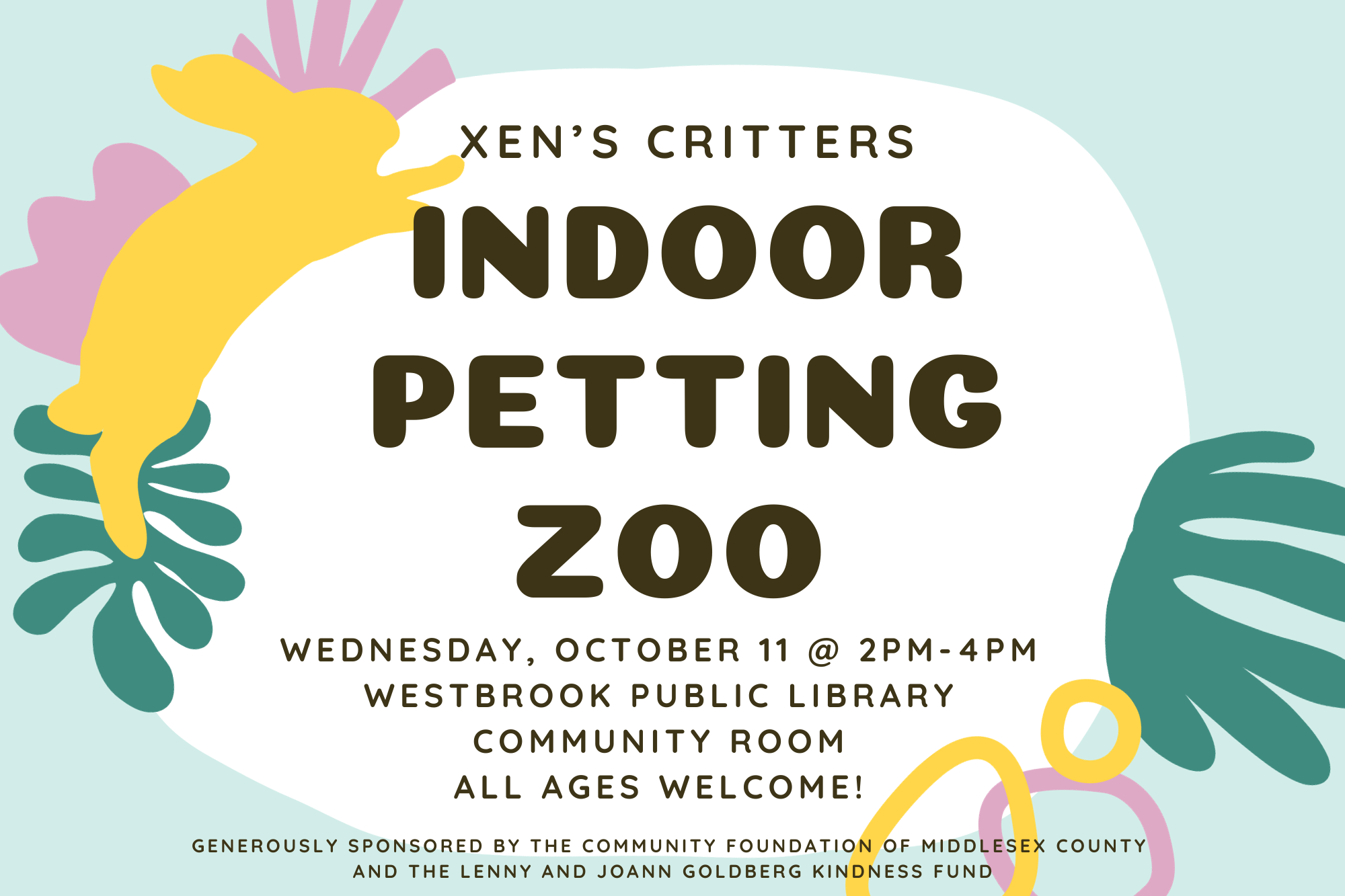

Lew Daniels Technology Center Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesXen’s Critters

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesCelebrate National Spread Joy Day with Xen’s Critters! Cuddle bunnies, chickens, ducks and more and have your questions answered by an animal expert. All ages are welcome! This program is funded by the Community Foundation of Middlesex County Lenny and JoAnn Goldberg Kindness Fund.

Canceled Understanding Alzheimer’s and Dementia

Community Room Westbrook Public Library 61 Goodspeed Drive, Westbrook, CT, United StatesThis program has been canceled. If you or someone you love has been impacted by Alzheimer's or dementia, we want to be sure that you have access to all of the information and support that you need. Please see the flyer for many free and confidential resources available to everyone, including: 24 Hr Helpline: 800-272-3900 ...